Do you know the story of The Goose

Do you know the story of The Goose

that laid Golden Eggs? Children everywhere know that a family once had a bird that laid golden eggs and made the family rich. But the stupid father tried to dig inside the goose to make it lay even more eggs, or lay them faster. The goose died and the family was soon broke. It’s a moral tale, of course, that you have to treat your sources of wealth well, or they will give up and you will be penniless.

The stock option market is a Golden Goose that lays weekly, monthly and yearly “eggs”. Tiger’s method of trading shows how to take advantage by properly managing your portfolio, balancing risk and reward, and creating success by steady repetition of moderate results. LIke eggs in the story, options will provide steady profits, but will fail the greedy trader who thinks he can kill the goose (such as asking for too much premium in a credit spread) and still get the golden eggs. Traders should respect the risk-reward ratios of various strategies and not let greed cause them to be too optimistic.

Here are Tiger’s rules for treating your Golden Goose well!

1. Partition your $100,000 paper account or “farm” into 20 “baskets”.

Once you have set up you thinkorswim account and found your PaperTrade account, you will notice on the upper left that you have $100,000 in your account. (If it says $200,000, then you need to select the “margin account” instead of “TOTAL”). Let’s call this your “farm”.

Now imagine this account is divided into twenty equal segments of $5,000 each.

You will keep space for up to twenty option positions, your “baskets,” as they say. Each basket accounts for $5,000 of margin money, making a total of $100k. This partition provides safety through diversity and enables you to accurately compare the performance of each “basket”. Diversity reduces risk. Segmenting encourages accountability.

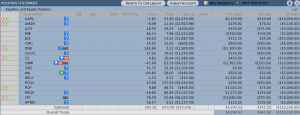

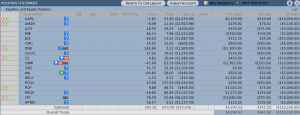

Here is an example of $100,0 portfolio, with underlying stock listed on the left, and the margin amount for each basket on the right column.

You will see that most “eggs” require $5,000 of margin capital (or multiples such as $10,000. I have added another egg or two in some cases, in view of the fact that many positions are about to expire.). Successful traders using our method keep their twenty baskets full.

Q. My trading platform only allows me $25,000 paper money. What should I do?

A. Either reduce the number of “eggs” to five. Or reduce the number of contracts per position to two or three. Or, better yet, open a paper account with a company that gives you $100k, such as TDAAmeeitrade’s thinkorswim.

2. Using filters, choose the 10 – 20 best candidates in your price range.

Tiger recommends that traders pick a price range they are comfortable with, and choose stocks within that range they are willing to follow. To try this out, use the SCAN function to find optionable stocks in these three price categories:

ABOVE $200. These include AAPL, GOOG, PCLN, CMG and other highly successful companies. They generate high amounts of premium, are usually directional, have adequate volume of open interest, and so are ideal for premium sellers using Credit Spreads. Others such as MIDD and NEU have good-looking charts, but the volume of trading is so low you might not get filled, so I eliminate them.

100-200. Such as IBM, GS, and many veteran of the older economy. These stocks generate moderate premium and are often best traded using Iron Condors.

50-100. Many stable and core economy stocks such as Citibank are stuck with low growth and generate low amounts of option premiums. Ideal for selling Covered Calls.

10-50. Forget it, except for earnings announcements and LEAPS !

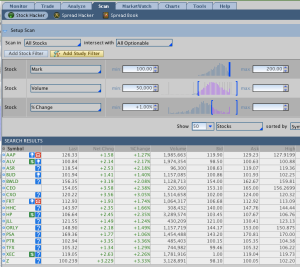

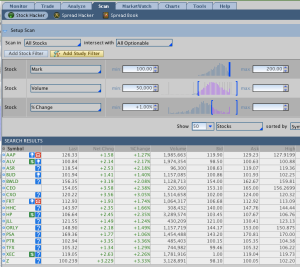

To get the best in these lower-priced categories, you need stocks that move a lot (higher volatility). So use the SCAN function to filter for 1-3% movement per da or a

beta” of 1 or greater. Keep adjusting the volatility and volume until you get a basket of 15-20 trade candidates. Here the TOS scan was set for stocks priced $100-200 and 1% change in price, producing 17 tradable stocks.

3. Choose your strategy and strikes, and calculate the amount of margin required by your platform for each position.

The formula for credit spreads is MARGIN = CREDIT + RISK. Using options on stocks >$200, I mostly use strikes $5 apart. The $5,000 rule enables me to easily calculate the margin on each position (using 10 contracts or 1,000 shares). So total margin required on 10 contracts with $5 width between strikes is $5,000.

FORMULA 1000 X (Strike 1 – Strike 2) — credit = MARGIN

EXAMPLE 1000 X (550 — 545) — 1.60 = $3,400

Here are the formulae: for common strategies. (See The Bible of Option Strategies for more info.)

Bull

Put Spread (CREDIT) |

Buy Put and Short Put (Strike Price Long Put < Strike Price Short Put) |

Net Premium + (Strike Price Short Put – Strike Price Long Put) x Contracts x Multiplier |

(Strike Price Short Put – Strike Price Long Put) x Contracts x Multiplier |

Net Premium + (Strike Price Short Put – Strike Price Long Put) x Contracts x Multiplier |

Example: AAPL Bull Put Spread: Sell 10 March 505 Puts, Buy 10 March 500 Puts for a credit of $1.60. Margin = 1000 X (505 – 500) – 1.6 which totals $3,400. I have a credit of $1,600 and so the net taken out of my account to cover the position is reduced to $3,400. So this “egg” has a maximum profit of $1,600 and a potential loss or risk of $3,400. Together they make up the margin requirement

Q: “What if the strikes are $10 apart, instead of $5 ?”

A: Then reduce the number of contracts to 5, so total margin required is still $5,000. Your “eggs” will have different credit amounts, but the total margin should be the same.

Q: What about Iron Condors? Do I need to double the margin?

A: No. An Iron Condor is a combination of two credit spreads, both at the same expiration, but there will be only one margin requirement, as the risk to the broker remains the same for two as for one. (Why? Because the expiration price cannot be in two places at the same time.)

3. Set separate close-out prices for each leg of your position.

Once you have fills, you now have “eggs” in your baskets. Ideally, credit spreads will close out at $0.00 at expiration, but that is not always the wisest thing. I usually set a buy-out price at $.05 or .10 GTC and wait until it fills. If the stock moves strongly, the order can be filled in days. So my profit would be initial credit minus the $0.05 or more than 95% of my profit potential.

Q: What about Iron Condors?

A. See above about keeping separate buy orders for each leg. However, if I’m at expiration day, I’ll usually roll the positions over to next month.

4. Keep your baskets full. Replace expiring “eggs” with new ones every month.

Using the Rollover menu on thinkorswim, it is easy to move your positions from this month to next month and pay only one set of commissions. If there is $0.35 of profit left in a trade, but I have to wait two weeks to realize it, then it may be better to close it out now and reinvest that margin money in the next month. By rolling over from month to month, I keep putting new “eggs” in the same “basket” and recording more profit.

Tiger says: “Never put all your eggs in one basket! Put them in 20 baskets!”

Copyright © 2014 Graeme Sharrock and Honolulu Options Traders | All rights reserved worldwide. | P.O. Box 75343, Honolulu, HI 96836

============================

HOMEWORK FOR Honolulu Options Traders CLASS.

Time needed: one hour

1. Set up your farm of 20 “baskets” by choosing 20 potential trades or “eggs”. You can choose them all from the $200+, $100-200, or $50-100 categories, or make a mix if you wish.

2. Take five “eggs” and recommend a strategy and strikes for each each.

3. in the Comments below, send in your list from 2. above, and we’ll see you next class.

Copyright © 2014 Graeme Sharrock and Honolulu Options Traders | All rights reserved worldwide. | P.O. Box 75343, Honolulu, HI 96836